Let's help your team get the care they need

With the Paytient card, employees can pay for care for their whole family — including pets. After each transaction, they choose an interest-free payment plan that fits their budget.

Not familiar with Paytient? Check out our Paytient Quick Start Guide to get up to speed on the new benefit employers and employees are raving about.

The Paytient card helps employees access and afford care with interest-free credit

![]() On-demand line of credit with limit set by the employer

On-demand line of credit with limit set by the employer

![]() Pays for medical, dental, vision, pharmacy, and vet care

Pays for medical, dental, vision, pharmacy, and vet care

![]() No credit check promotes equitable access

No credit check promotes equitable access

![]() Employers are not on the hook for any unpaid balances

Employers are not on the hook for any unpaid balances

Give your team a benefit they'll love

With Paytient, people can pay for care they’ve put off (e.g., a new pair of glasses or a visit to a therapist) and handle unexpected healthcare expenses.

Members simply swipe their Paytient card and set up a payment plan, turning bills into a series of payroll or HSA deductions — all without interest or fees. No wonder we have an average Net Promoter Score of 93!

The ideal solution for today's problems - and tomorrow's

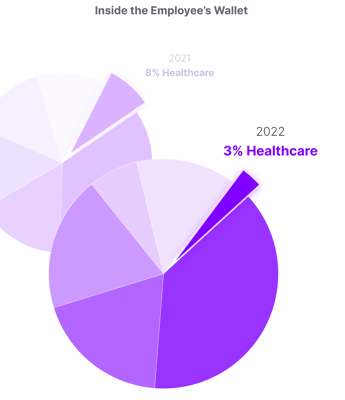

Inflation is shrinking employees’ healthcare wallets and making it difficult for people to afford to get care.

Paychecks are not going as far as they once did, forcing folks to navigate painful decisions to make ends meet. Based on inflation trends, an employee who makes $50,000 a year actually has $2,500 less* to spend on healthcare than they did just 12 months ago.

Employees need a healthier way to pay for care. Paytient works alongside your existing benefits package to eliminate cost as a barrier to treatment.

Proactive care is cheaper than reactive care

Being able to split the $100 out-of-pocket cost to get a cavity filled at the dentist into five monthly payments of $20 is much better than deferring care and then seeing that cavity turn into a $1,000 root canal.

But the power of Paytient doesn't stop there.

With Paytient, employers can:

Increase Employee Retention

At a time when open jobs far outpace available workers, every company wants to retain talent. Employees with a Paytient account have a turnover rate 2.2 times lower than those who don’t have Paytient.

Advance Health Equity

Health plans with high out-of-pocket costs have historically disadvantaged vulnerable employees who have less disposable income and lower credit scores. Paytient makes your health benefits more equitable by affording all employees access to credit, without a credit check, so they can get the care they need and pay their out-of-pocket costs over time with no interest or fees.

Fill Benefits Gaps

With 60% of Americans living paycheck to paycheck, including 36% of those who earn $250,000 or more, Paytient helps people avoid unexpected care costs by filling gaps in their benefits. Whether people need a hand paying for dental, medical, pharmacy, vision, or veterinary needs, Paytient connects people with the care they need.

Drive Lower-Cost Health Plan Adoption

Health plans with lower costs can benefit employees and employers alike, though concerns about making the transition can give people anxiety. Paytient can provide peace of mind while steering employees toward whatever plan you prefer. One client was able to increase its HDHP adoption from 50% to 85%, resulting in a 12x return on investment for implementing Paytient.

Provide Cost-Effective Support

Companies and employees alike sometimes feel pulled between physical and financial wellness. Paytient is the most affordable way to help employees access care without paying the full cost of that care.

Boost Health Plan Optionality

Employees have diverse healthcare priorities, including everything from mental health to physical therapy to infertility. Many employees are caring for partners, children, parents, and pets in addition to themselves. Since Paytient is accepted at any provider that takes Visa cards, it's one benefit that unlocks access to a wide spectrum of care needs.

Reduce Large Claims

Paytient helps create a healthier dynamic in healthcare benefits programs. When you make healthcare more affordable, out-of-pocket costs become more manageable for employees. This empowers them to get care sooner, which reduces the likelihood of large claims and puts less pressure on health benefit prices in subsequent years.